Safeguard Your Home and Loved Ones With Affordable Home Insurance Coverage Program

Importance of Affordable Home Insurance Coverage

Protecting budget-friendly home insurance coverage is vital for guarding one's property and financial well-being. Home insurance gives defense against various threats such as fire, theft, all-natural disasters, and individual responsibility. By having a comprehensive insurance strategy in position, property owners can rest ensured that their most considerable investment is protected in case of unanticipated situations.

Budget-friendly home insurance not just supplies financial safety but additionally provides peace of mind (San Diego Home Insurance). When faced with rising property worths and construction expenses, having an affordable insurance plan makes certain that house owners can easily reconstruct or fix their homes without dealing with substantial monetary burdens

Additionally, economical home insurance policy can likewise cover individual possessions within the home, supplying reimbursement for things damaged or swiped. This insurance coverage prolongs past the physical structure of your home, protecting the materials that make a residence a home.

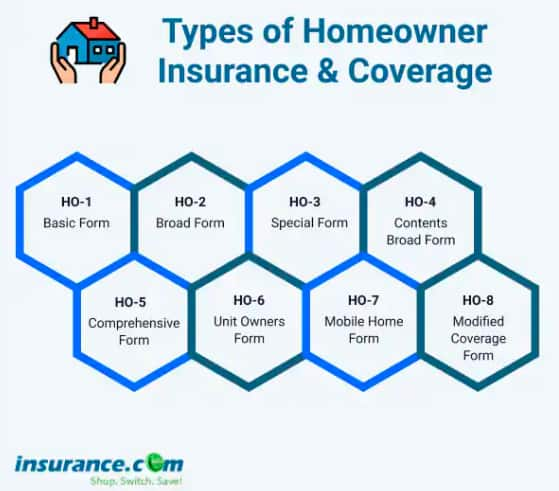

Protection Options and Purviews

When it pertains to insurance coverage limits, it's important to recognize the maximum amount your policy will certainly pay for each type of protection. These limitations can differ relying on the policy and insurance firm, so it's necessary to assess them thoroughly to ensure you have appropriate protection for your home and possessions. By comprehending the insurance coverage options and limits of your home insurance coverage, you can make educated choices to secure your home and enjoyed ones properly.

Variables Affecting Insurance Costs

Numerous variables dramatically influence the prices of home insurance policy plans. The place of your home plays an important role in determining the insurance policy premium.

In addition, the kind of coverage you select directly affects the cost of your insurance plan. Going with additional insurance coverage options such as flooding insurance coverage or quake protection will certainly boost your premium. In a similar way, choosing greater protection limits will cause higher costs. Your insurance deductible quantity can also influence your insurance prices. A higher deductible usually suggests lower premiums, yet you will certainly have to pay look at here even more out of pocket find more in case of a case.

Furthermore, your credit report, asserts background, and the insurance company you select can all affect the cost of your home insurance coverage plan. By taking into consideration these factors, you can make informed decisions to aid handle your insurance coverage sets you back properly.

Comparing Quotes and Suppliers

Along with comparing quotes, it is vital to review the credibility and monetary stability of the insurance coverage carriers. Look for client testimonials, scores from independent companies, and any kind of history of grievances or governing activities. A trustworthy insurance policy service provider ought to have a great record of without delay refining cases and providing outstanding customer support.

Additionally, think about the certain insurance coverage features offered by each carrier. Some insurance providers may offer added advantages such as identification burglary protection, tools malfunction protection, or protection for high-value things. By meticulously contrasting quotes and carriers, you can make an informed decision and choose the home insurance policy plan that ideal satisfies your needs.

Tips for Reducing Home Insurance Coverage

After thoroughly contrasting providers and quotes to discover one of the most appropriate insurance coverage for your requirements and spending plan, it is prudent to discover effective approaches for reducing home insurance policy. One of one of the most significant methods to reduce home insurance is by bundling your plans. Many insurance provider offer discount rates if you acquire multiple policies from them, such as incorporating your home and auto insurance coverage. Raising your home's safety and security actions can also cause savings. Mounting safety and security systems, smoke alarm, deadbolts, or a lawn sprinkler can decrease the danger of damages or burglary, possibly lowering your insurance premiums. Furthermore, keeping an excellent debt score can positively impact your home insurance coverage rates. Insurance firms often consider credit report when establishing costs, so paying costs promptly and handling your credit score sensibly can cause reduced insurance policy costs. Routinely evaluating and updating your plan to mirror any kind of adjustments in your home or conditions can guarantee you are not paying for protection you no longer requirement, assisting you save cash on your home insurance premiums.

Final Thought

In final thought, securing your home and enjoyed ones with inexpensive home insurance coverage is vital. Carrying out pointers for conserving on home insurance policy can additionally aid you safeguard the necessary security for your home without breaking the bank.

By unwinding the ins and outs of home insurance plans and exploring practical techniques for protecting cost effective coverage, you can ensure that your home and loved ones are well-protected.

Home insurance policies usually use numerous insurance coverage options to safeguard your home and personal belongings - San Diego Home Insurance. By comprehending website link the protection choices and restrictions of your home insurance coverage plan, you can make educated decisions to secure your home and enjoyed ones properly

Regularly assessing and updating your plan to show any changes in your home or scenarios can guarantee you are not paying for protection you no longer requirement, helping you conserve cash on your home insurance coverage costs.

In verdict, guarding your home and loved ones with cost effective home insurance policy is important.